A Turbo Bull Note, or Bull TBN, is a structured product designed for investors who want unlimited upside participation when the underlying stocks rise. With a Participation Rate (PR) that can exceed 1x, it acts like a “turbo boost,” accelerating gains when your market view is correct. If the stock moves against your expectation, the downside behaves like holding the stock directly—while automatically limiting losses through built-in principal protection.

Turbo Bull Note is a structured note linked to two stocks in the SET50 Index. Its return is based on the price performance of the Least Performing Security (LPS) on the Valuation Date, compared with the initial price on the trade date, multiplied by the Participation Rate (PR). The PR can significantly enhance return potential.

The PR level depends on factors such as the chosen underlying stocks, the degree of principal protection, and the contract tenor (typically 1 to 3 months). Investors can customize these features to suit their investment goals and risk appetite.

Capture gains from rising underlying stocks without an upside cap.

If PR is 200% and the LPS rises 10%, the note pays 20% (before 15% withholding tax).

Downside is limited through principal protection up to 95%.

Note: This product is for Institutional investors and High Net Worth investors only, as in Announcement by the SEC.

Please understand the product’s features, return conditions, and risk before making an investment decision.

Important Notice: Investors in Structured Notes expose to risk of losing all or part of their investment if there is no principal protection or less than 100% principal protection of the investment. Structured Notes are the notes with higher risks or greater complexity than ordinary debentures, and they differ from direct investments in the underlying assets. This may result in the price of such notes exhibiting different fluctuations from underlying prices. Therefore, investors should thoroughly understand the terms of return and carefully consider the potential risks before making investment decisions. Please review the information and details provided in the factsheet or seek additional advice from your investment consultant.

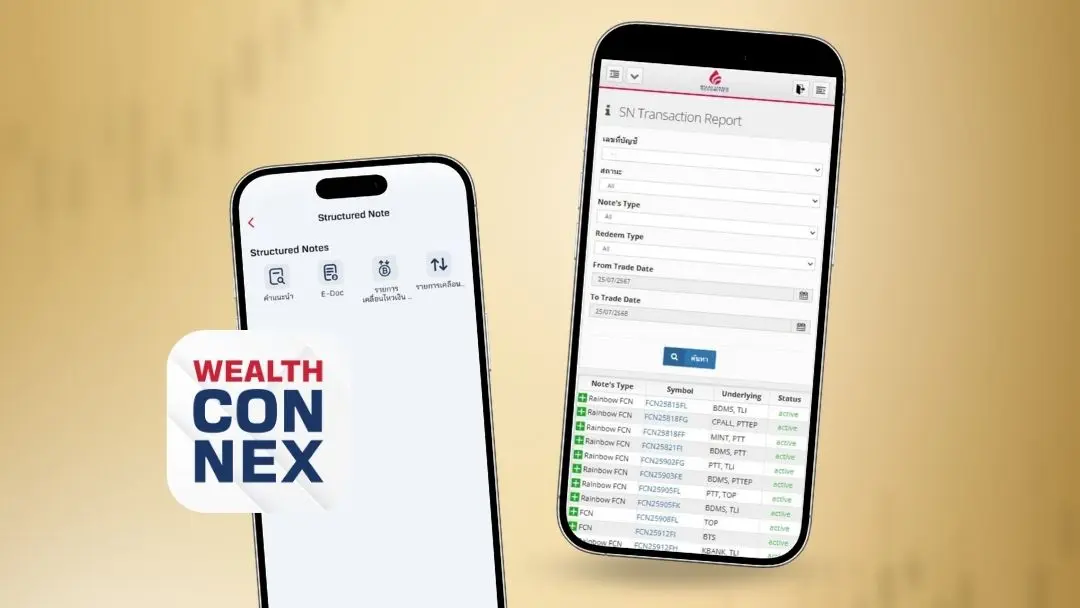

Start Investing in Structured Notes Easily, Available for institutional and high-net-worth investors as defined by the SEC. Just open a securities trading account — quick and easy approval.

1. Prepare your ID card to fill in your information.

2. Apply for a securities account through various channels. See how to Click

• Wealth Connex app / AomWise app / www.bualuang.co.th

• Bualuang Securities branch

3. Open a Structured Note account by submitting: A copy of your ID card and Proof of high-net-worth investor status, as in Announcement by the SEC. See more Click

4. Submit your documents to your investment advisor and wait for email approval.

5. Start investing in Structured Notes by contacting your advisor to design a product that fits your investment style.

The minimum investment amount is 500,000 Baht.

Bull TBN is always redeemed in cash. If held to maturity, the redemption value depends on the price change of the Least Performing Security (LPS) on the Valuation Date compared with the initial price.

The contract tenor ranges from 1 to 3 months.

For example, a PR of 200% means the return equals 2 times the price change of the LPS. If the LPS rises +10%, the investor receives +20% of the principal.

Investors may incur losses if, at redemption, the LPS price falls below the pre-agreed strike price. However, a portion of the principal is protected according to the contract design set from the start.