SSF Block Trade is a method of trading Single Stock Futures (SSF), which are futures contracts based on individual stocks. It helps solve the liquidity issue on the TFEX. Brokers act as counterparties to facilitate buying or selling SSFs at the desired price and volume.

It suits investors who want to profit from both long and short positions or hedge their portfolio. SSF Block Trade requires less capital than trading actual stocks (only 5–25% margin), has lower fees, and offers the chance to receive dividends if holding a Long position until the XD date. It is a flexible tool for portfolio management in all market conditions.

Boost your single-stock trading power at every market moment with Single Stock Futures Block Trade

Don’t miss dividend opportunities for Long position holders.

Plan comprehensively with expert guidance, trading tools, and performance analysis reports via iTracker.

Trade through your Investment Consultant or via the online system (please review the terms and conditions by clicking here).

Investment involves risk. If the underlying price direction is misjudged, losses may exceed those of direct stock investment. Contracts have expiration dates. Investors should fully understand the information before making any investment decision.

Plan your strategy using the Block Trade Calculator. Low interest rates help reduce your trading costs. Check interest rates Click

Investors who hold a Long position until the stock’s XD date may receive dividends — just like holding real shares. Learn more Click

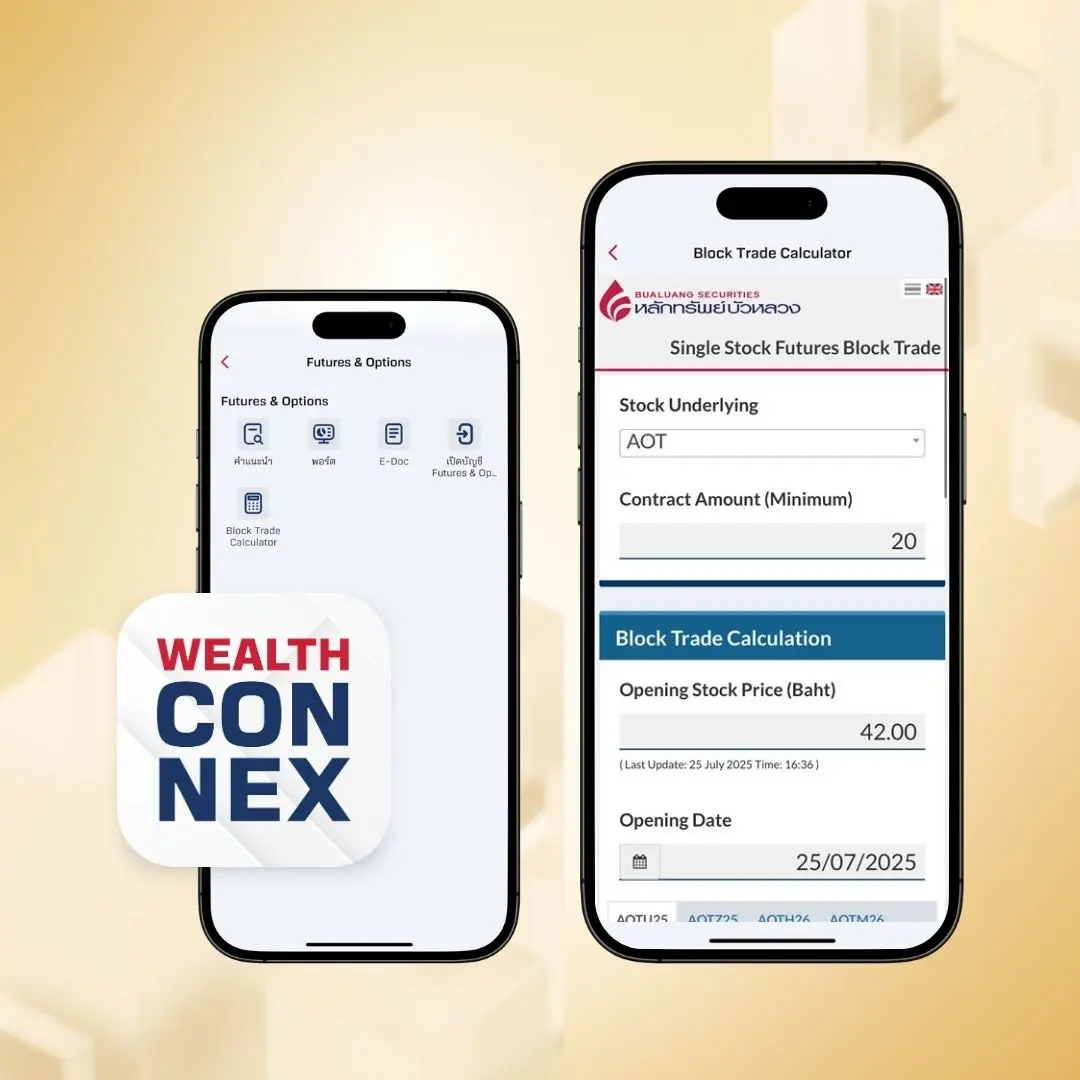

Receive daily Block Trade updates and strategies in both morning and evening sessions from professional analysts via the Wealth Connex app. Install now Click

Start opening a Derivatives account for Block Trade easily with quick approval and begin Investing.

1. Prepare your ID card to fill in your information.

2. Apply for a securities account through various channels. See how to Click

- Wealth Connex app / AomWise app / www.bualuang.co.th

- Bualuang Securities branch

3. Wait for account approval via email.

4. Next, choose the type of account you want to open for Block Trade See how to Click via:

- Wealth Connex app, Solution menu

- Streaming app, BLS > Futures and Options menu

- www.bualuang.co.th, BLS > Futures and Options menu

5. Fund your account and place orders through your investment consultant. Check Interest rates Click or See more Click

No. Investors must close their positions by 4:00 PM on the contract's expiration date.