This account gives you leverage, with Bualuang Securities offering an Initial Margin of up to 50:50. This means you can double your investment. For example, if you want to buy stocks worth 100,000 THB, you can use only 50,000 THB of your own funds and borrow the remaining 50,000 THB from the company. While this increases your potential for higher profits, it also comes with a higher risk of losses. Therefore, it is best suited for experienced investors.

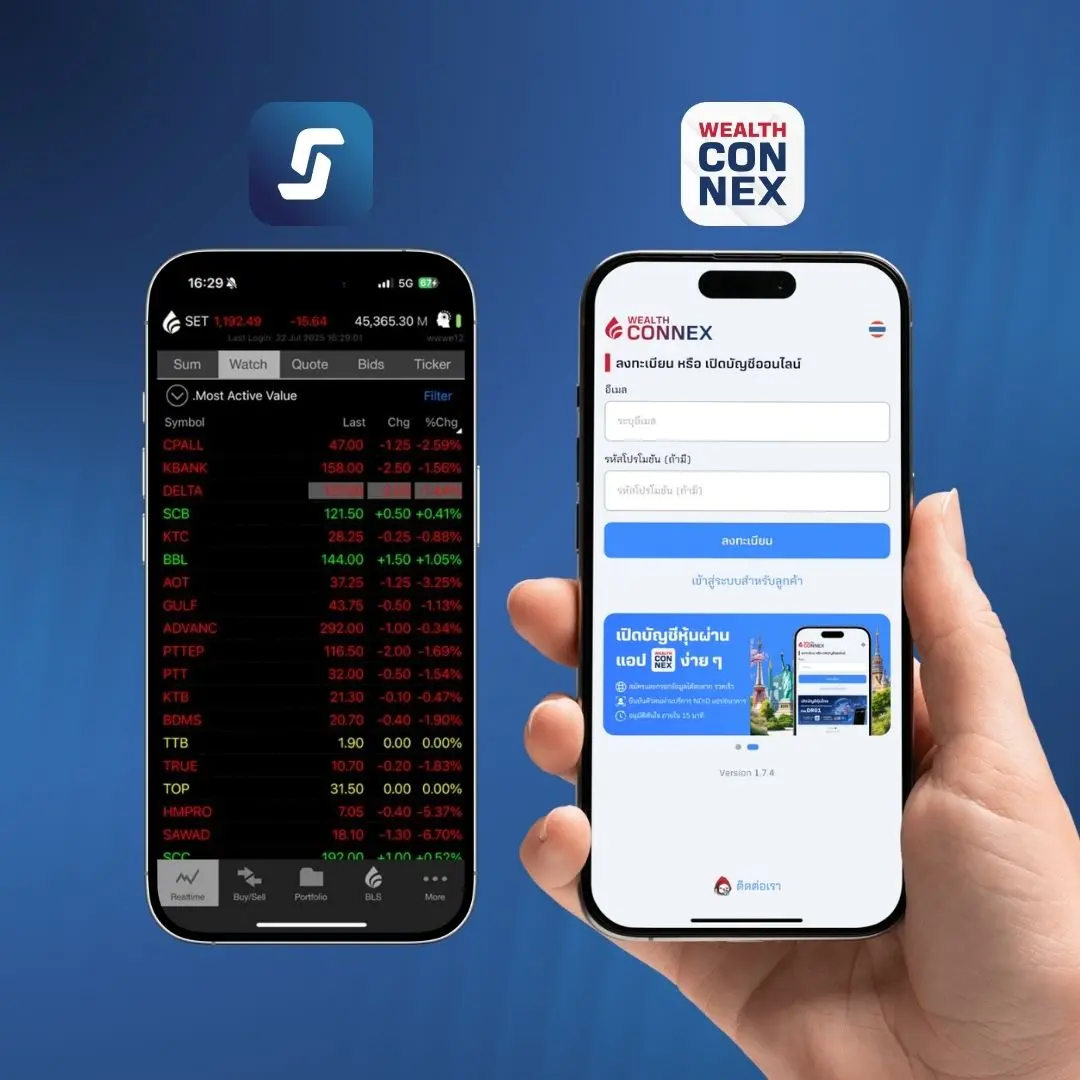

Place real-time trade orders through the Streaming app, Aspen Bualuang Trade, Trade Master, or on the website. See how to Click

Stay updated with stock insights and target prices from Bualuang Securities’ expert team through the Wealth Connex app. Install now Click

Receive investment advice and all the tools you need to achieve your goals, exclusively for Bualuang Securities clients.

Start opening a Margin Account (Credit Balance) with Bualuang Securities to Boost Your Investment Power

1. Prepare your ID card to fill in your information.

2. Apply for a securities trading account through various channels. See how to Click

- Wealth Connex app / AomWise app / www.bualuang.co.th

- Bualuang Securities branch

3. Start investing and maintain at least 6 months of trading history to make opening a margin account easier.

4. Complete the Margin Account Opening Request Form and attach the required documents: a copy of your ID card, house registration, bank account front page, and a 3-month bank statement showing a minimum balance of 1,000,000 Baht. Please send the original documents to Bualuang Securities. See branches Click

5. Deposit stocks or funds into your account and start trading via the Streaming app, Aspen Bualuang Trade, or Trade Master. Check the fees Click or Check loan interest rates Click

If your pledged stocks or margin portfolio decline sharply, you may face a force sell, which can further drive down prices.

Margin accounts allow you to enhance your investment capacity by contributing half the capital and borrowing the rest. While this increases your buying power, it also increases risk, as you’re responsible for the full investment value and must pay interest on the borrowed amount.

You can only trade or pledge stocks listed on the "Marginable Securities" list, which varies by broker.

Check the latest list at: https://bls.tips/Marginlist