Investing in a Shark Fin Note (SFN) is a type of structured note with principal protection, offering an alternative for investors seeking higher returns than bank deposits. It provides up to 100% principal protection if held to maturity, with final returns depending on predefined conditions and the performance of the underlying asset.

Ideal for investors with a view that the SET50 Index will move within a narrow range, and who seek higher returns than deposits without risking their principal.

With Shark Fin Notes (SFN), investors can customize the contract — including the tenor and participation rate — to align with their investment objectives.

Invest with confidence, knowing your capital is protected up to 100% if held to maturity — while still having the potential to earn higher returns than traditional deposits.

Investors can capture market opportunities by placing buy orders on any business day — with no transaction fees.

Choose between a 6-month or 12-month contract, with a Participation Rate of 50% or 100%, tailored to your investment goals and risk appetite.

Note: This product is for Institutional investors and High Net Worth investors only, as in Announcement by the SEC.

Please understand the product’s features, return conditions, and risk before making an investment decision.

Important Notice: The principal amount is protected at the insured value only if the investor holds the investment until maturity. Investors in Structured Notes expose to risk of losing all or part of their investment if there is no principal protection or less than 100% principal protection of the investment. Structured Notes are the notes with higher risks or greater complexity than ordinary debentures, and they differ from direct investments in the underlying assets. This may result in the price of such notes exhibiting different fluctuations from underlying prices. Therefore, investors should thoroughly understand the terms of return and carefully consider the potential risks before making investment decisions. Please review the information and details provided in the factsheet or seek additional advice from your investment consultant.

Start Investing in Structured Notes Easily, Available for institutional and high-net-worth investors as defined by the SEC. Just open a securities trading account — quick and easy approval.

1. Prepare your ID card to fill in your information.

2. Apply for a securities account through various channels. See how to Click

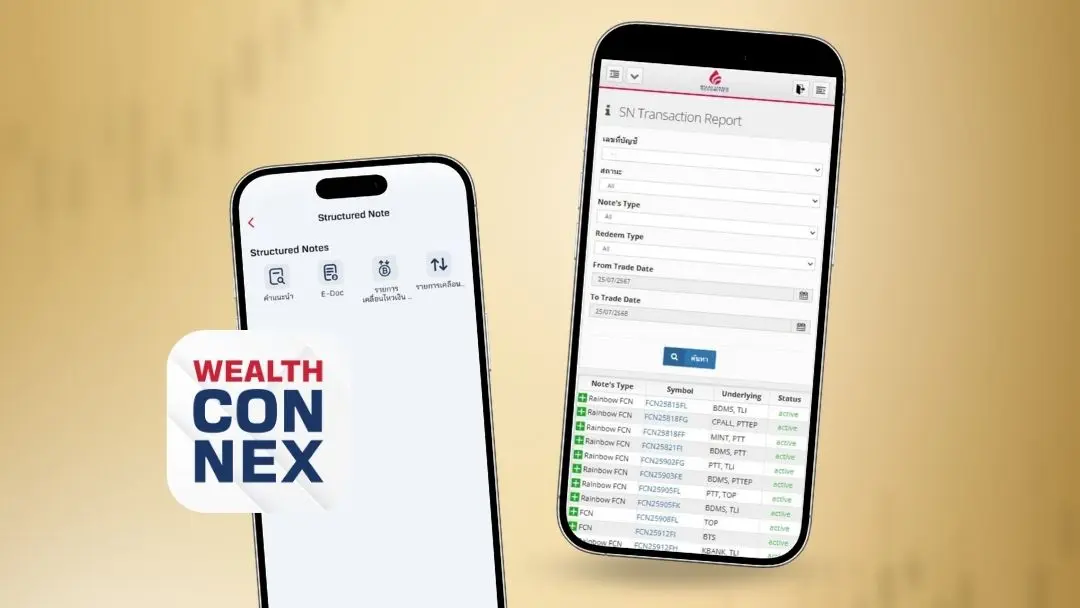

• Wealth Connex app / AomWise app / www.bualuang.co.th

• Bualuang Securities branch

3. Open a Structured Note account by submitting: A copy of your ID card and Proof of high-net-worth investor status, as in Announcement by the SEC. See more Click

4. Submit your documents to your investment advisor and wait for email approval.

5. Start investing in Structured Notes by contacting your advisor to design a product that fits your investment style.

The Participation Rate (PR) represents the percentage of index movement an investor will participate in.

For example, if PR = 100%, and the reference index rises by 5%, the investor receives a 5% return on principal — assuming no Knock-Out event occurs.

SFN offers contract terms of 6 months or 12 months.

Returns are paid as a lump sum at maturity.

Investors may not receive full principal if the contract is terminated early, or returns may be reduced to a Rebate Rate. if a Knock-Out occurs.