In today’s fast-changing investment world, investors are constantly seeking strategies that can both enhance returns and manage risks effectively. Leveraged & Inverse ETFs (L&I ETFs) have become popular investment tools globally and are now drawing increasing interest among Thai investors to generate opportunities in both rising and falling markets.

However, since foreign L&I ETFs are more complex and riskier than common ETFs, Thai regulators have implemented measures to protect investors. Recently, the Securities and Exchange Commission of Thailand (SEC) updated its regulations on foreign L&I ETFs to better suit Thai investors. The key amendment states:

“Non–Ultra High Net Worth (UHNW)* investors are allowed to trade only foreign L&I ETFs with a leverage ratio not exceeding 2x, and the ratio must be an integer (not fractional), as such products remain relatively unfamiliar to Thai investors.”

Note: *UHNW refers to investors with total assets of at least THB 30 million.

This marks an important opportunity for Thai investors to access and benefit from foreign L&I ETFs. In this article, BLS Global Investing team will guide you through what foreign L&I ETFs are and how they work.

What is an ETF?

An ETF (Exchange-Traded Fund) is an investment fund that trades on an exchange like a stock. ETFs are designed to track indices, stocks, or other assets.

What are Leveraged & Inverse ETFs?

Foreign L&I ETFs are investment tools that provide exposure to both up and down-market movements through the use of leverage (amplifying returns) or inverse mechanisms (moving opposite to the benchmark).

- Leveraged ETFs: Designed to magnify the performance of a benchmark index. For instance, a 2X Leveraged ETF aims to deliver twice the daily return of the underlying index.

- Inverse ETFs: Designed to generate the opposite return of a benchmark index. If the index declines, an Inverse ETF will rise making it a useful tool for hedging in down markets.

However, because of their complexity and higher risk, investors should fully understand their structure before investing.

How Do Leveraged & Inverse ETFs Work?

Foreign L&I ETFs employ financial derivatives to achieve their targeted leverage or inverse performance, such as:

- Futures: Used to replicate index movements.

- Leveraged ETFs buy futures contracts when expecting the index to rise.

- Inverse ETFs sell futures contracts to profit from downward movements.

- Swaps: Used to exchange returns with financial institutions (e.g., banks), allowing the ETF to receive the desired leveraged or inverse exposure to the reference index.

Key Concepts Investors Must Understand

Before investing, it’s crucial to understand daily resets and compounding effects:

Daily Reset:

L&I ETFs reset their leverage ratio daily, recalculating returns based on the previous day’s closing price. Holding positions for more than one day may lead to returns that deviate from the stated leverage due to compounding effects.

Compounding Effect:

Due to the returns are recalculated daily, cumulative performance over multiple days may differ from the expected leveraged multiple especially in volatile markets.

🚨 Therefore, L&I ETFs are not suitable for long-term holding and are best suited for short-term trading (usually within one day).

Examples

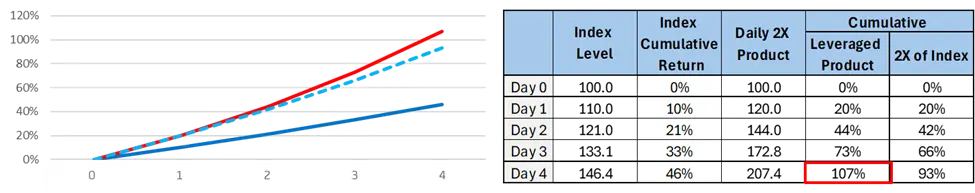

1. Continuous Uptrend:

If the index rises 10% each day for four days, the 2X ETF could yield 107% cumulative return, exceeding twice the benchmark’s 46% gain due to compounding effect.

.webp)

.webp)

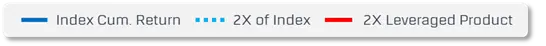

2. Continuous Downtrend:

If the index falls 10% each day for four days, the 2X ETF might lose 59%, which is less than twice the index’s 34% cumulative decline.

.webp)

_1.webp)

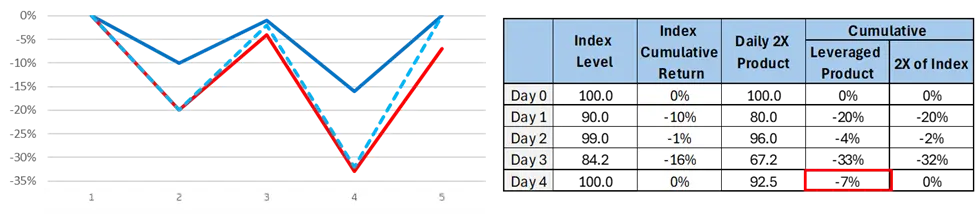

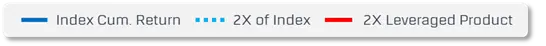

3. Sideways trend:

If the index fluctuates narrowly and ends unchanged after four days, the 2X ETF could still lose about 7%, as compounding effect erodes returns.

.webp)

.webp)

Key Benefits and Risks of Foreign L&I ETFs

Advantages:

- Potential for amplified returns

- Ability to profit in both up and down markets

- Flexibility — tradable like common stocks

Risks to consider:

- Tracking Error Risk: Return deviations from the benchmark index.

- Market Risk: Price fluctuations due to volatility.

- Liquidity Risk: Difficulty trading at desired prices.

- FX Risk: Currency exchange rate fluctuations.

- Counterparty Risk: Failure of derivatives counterparties.

- Compounding Risk: Cumulative returns differ from expected multiples.

- Long-Term Holding Risk: Unsuitable for holding beyond one day.

- Leverage & Inverse Risk: Added volatility from leveraged exposure.

- Higher Costs: Derivative usage may increase fees and transaction costs.

Types of Foreign L&I ETFs Accessible to General Investors

(For non-UHNW investors)

- Leveraged ETF (2X): Targets +200% of the index’s daily return.

- Inverse ETF (-1X): Targets -100%, moving opposite to the index.

- Inverse Leveraged ETF (-2X): Targets -200%, moving twice as much in the opposite direction.

(UHNW investors can trade foreign L&I ETFs with any leverage level.)

Who Are L&I ETFs Suitable For?

- Investors who clearly understand complex products, daily resets, and compounding.

- Those who monitor positions daily and can tolerate large potential losses.

- Experienced investors capable of analyzing risk, product structure, and valuation.

- Traders aiming for short-term opportunities in volatile markets.

- Investors who have acknowledged the product’s risk disclosure with their broker.

Who Are L&I ETFs Not Suitable For?

- Investors seeking long-term, stable investments.

- Those unable to monitor their portfolios closely.

- Risk-averse investors or those who cannot tolerate potential full losses.

- Investors unfamiliar with leveraged or inverse daily-return products.

How to Activate Trading Access for Foreign L&I ETFs

For non-UHNW investors, you can activate your trading rights in just 2 simple steps:

- Review and acknowledge the L&I ETFs Risk Disclosure Statement.

- Confirm your risk acknowledgment and your account will be activated within 3 business days!

Access channels:

1. Wealth Connex App:

Go to “L&I ETFs menu” → Read & acknowledge → Confirm risk acknowledgment.

2. Streaming App:

Go to “BLS” → “L&I ETFs menu”.

3. Bualuang Securities Website:

Visit www.bualuang.co.th → Pre-Trade → L&I ETFs.

💥 Don’t miss your chance to trade foreign L&I ETFs and capture opportunities in every market movement! 🤩

Data as of April 4, 2025.

.webp)